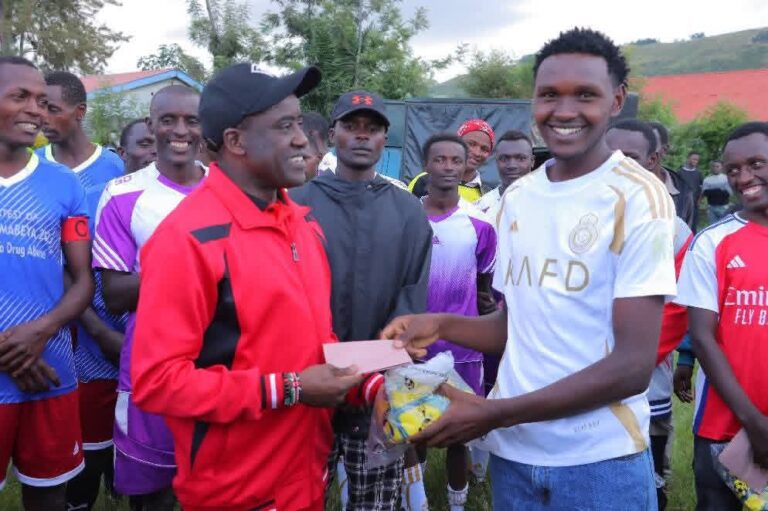

Molo MP Kimani kuri and Chairperson National Assembly Finance Committee has said that the MPS have rejected the move to give KRA powers to access Taxpayers data, says its unconstitutional. Photo: Kimani Kuria X.

The National Assembly Finance committee has recommended that Parliament drops the contentious 2025 Finance Bill, which seeks to give Kenya Revenue Authority powers to access tax payers personal and financial data.

The contentious clause 52 proposed law, proposes that section 59A(1B) of the Tax Procedures Act, which bars tax bodies like KRA from compelling businesses to share customer personal data, be repealed.

The move will see KRA being given unrestricted access to trade secrets, and personal data such as mobile money and bank transactions as the authority seeks to nab tax evaders.

During his Machakos tour Deputy President Kithure Kindiki had cautioned tax evaders that the government is instilling strict measures to ensure that they catch up with those evading the tax systems.

In a report by the Chairperson Finance Committee Kimani Kuria, the committee noted that the proposal does not meet Constitutional requirements, under Article 31 (c) and (d), which guarantees the freedom of privacy.

“It does not meet the constitutional threshold set under Article 3I(c) and (d) of the Constitution of Kenya, which guarantees every individual the right to privacy. The Committee also referenced Section 51 of the Data Protection Act, which outlines specific conditions under which exemptions to data protection may be permitted 1548,” read the report.

The MPs in the committee argued that the current provided legal frameworks, gives powers to the taxman with sufficient authority to access important data, as long as they provide a court order.

“Protecting personal privacy and adhering to judicial oversight not only reinforces public trust but also aligns Kenya’s approach with international best practices in data protection,” MPs argued.

The rejection comes as a section of institutions including LSK and Audit firm KPMG East Africa, had tabled their memoranda opposing the law, arguing that the law will undermine the taxpayers right to fair adjudication and due process.

However, the National Treasury CS John Mbadi, had defended his decision to give KRA access powers, as a necessary step to ensure compliance, as voluntary compliance had seen well-off citizens failing to declare their income.

“If it were up to us, even those earning well like me would not be honest in paying taxes. I will probably return 50-60 percent of what I am supposed to. People love convenience, especially where money is involved. If you just let Kenyans pay taxes at will without being followed up, they will not,” Mbadi stated earlier.

The move had also received a backing from KRA chairperson Ndiritu Muriithi. According to Muriithi, the new law would have increased revenue collection, and end the menace of tax evasion.